LIC Housing Loan Eligibility 2025 – Definitive Guide to Get Approved Faster

If you are planning to buy your dream home with LIC Housing Finance (LICHFL), understanding the eligibility criteria is the first step. Home loans are one of the biggest financial commitments, and meeting the right requirements can make your approval smooth and hassle-free.

Whether you are a salaried employee, self-employed professional, or NRI, this blog will give you the definitive roadmap to qualify for an LIC home loan in 2025.

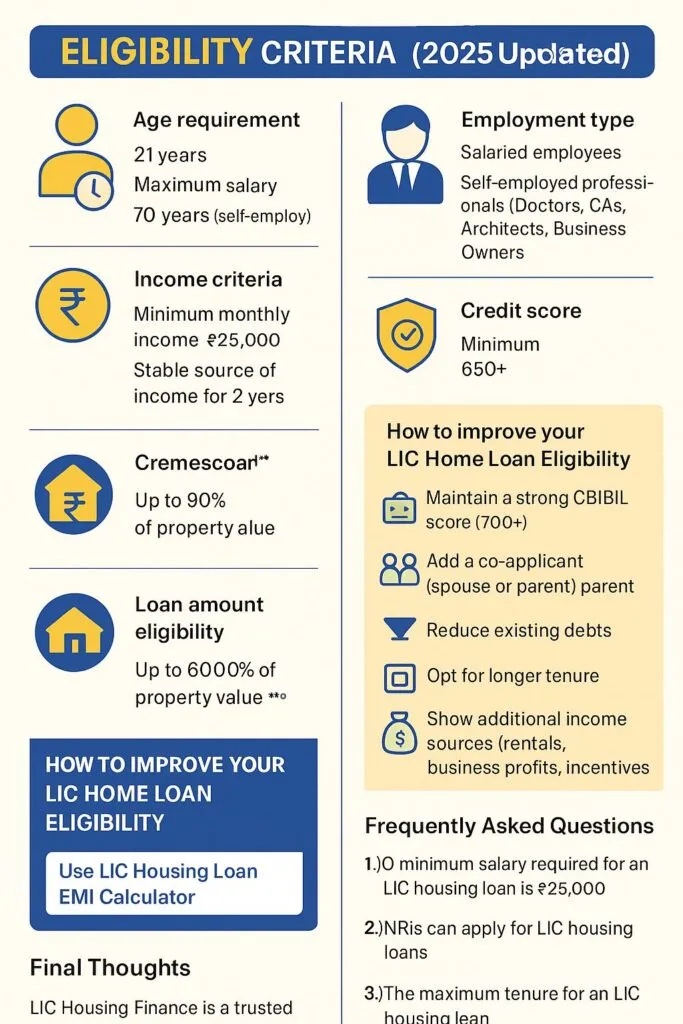

🔑 LIC Housing Loan Eligibility Criteria (2025 Updated)

LIC Housing Finance offers flexible home loan options, but you must meet certain criteria:

1. Age Requirement

- Minimum: 21 years

- Maximum: 60 years (salaried) / 70 years (self-employed) at loan maturity

2. Employment Type

- Salaried employees (private/public sector, government, PSU, MNCs)

- Self-employed professionals (Doctors, CAs, Architects, Business Owners)

- NRIs with verified overseas income

3. Income Criteria

- Minimum monthly income: ₹25,000 (varies with city & loan amount)

- Stable source of income for at least 2 years

4. Credit Score (CIBIL)

- Minimum: 650+ (higher score = better interest rates)

5. Loan Amount Eligibility

- Up to 90% of property value (for loans < ₹30 Lakhs)

- Up to 80% of property value (₹30 Lakhs – ₹75 Lakhs)

- Up to 75% of property value (above ₹75 Lakhs)

📂 Documents Required for LIC Housing Loan

To process your loan quickly, keep these documents ready:

For Salaried Applicants:

- PAN Card & Aadhaar Card

- Latest 3 months salary slips

- 6 months bank statements

- Form 16 / Income Tax Returns (ITR)

- Employment proof (ID card, offer/appointment letter)

For Self-Employed:

- PAN & Aadhaar

- Business Registration Proof / GST Certificate

- Last 3 years ITR with computation

- Last 12 months bank statements

- Balance sheet & Profit/Loss statement

👉 Check official LIC Housing Loan Document List here

💡 How to Improve Your LIC Home Loan Eligibility

Getting approved is not just about documents—it’s about financial planning. Here are expert tips:

- Maintain a strong CIBIL Score (700+) – Pay credit card bills & EMIs on time.

- Add a co-applicant (spouse/parent) – Increases loan amount eligibility.

- Reduce existing debts – Lower EMIs = higher chances of approval.

- Opt for longer tenure – Brings down EMI, making loan affordable.

- Show additional income sources – Rentals, business profits, incentives.

📊 LIC Housing Loan EMI Calculator

Before applying, calculate your eligibility with an EMI calculator:

👉 Use LIC Housing Loan EMI Calculator

Just enter your loan amount, tenure, and interest rate to know your monthly EMI instantly.

🤔 Frequently Asked Questions (FAQs)

1. What is the minimum salary required for LIC Housing Loan?

A minimum monthly salary of ₹25,000 is preferred, but higher income improves approval chances.

2. Can NRIs apply for LIC Housing Loans?

✅ Yes, NRIs with stable overseas income can apply.

3. What is the maximum tenure for LIC Housing Loan?

Up to 30 years, depending on your age and repayment capacity.

4. Does LIC offer a top-up loan?

Yes, existing borrowers with good repayment history can avail top-up loans.

✅ Final Thoughts

LIC Housing Finance is one of India’s most trusted housing loan providers. By fulfilling the eligibility criteria and preparing your documents in advance, you can fast-track your loan approval and move closer to owning your dream home.

If you’re in Hyderabad or anywhere in India, and looking for expert assistance with LIC Housing Loan, contact us today!

👉 Apply for LIC Housing Loan with Elite Financial Services – Your trusted DSA in Hyderabad.