LIC Home Loan Interest Rates & Types in Hyderabad (2024) – Get Expert Help!

Thinking of buying a dream home in Hyderabad? LIC Housing Finance offers some of the most attractive home loan schemes in India, with interest rates starting as low as 8.50%*. But navigating loan options and securing the best rates can be overwhelming.

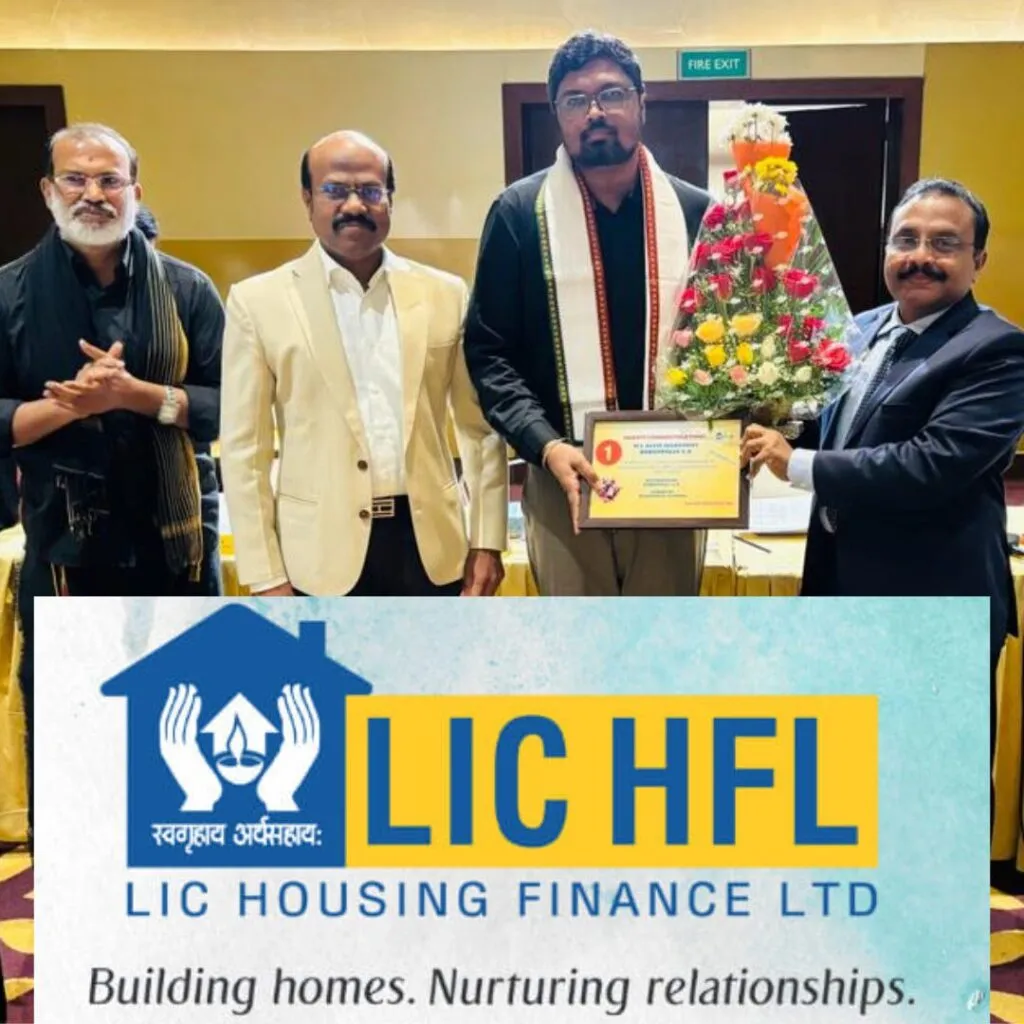

That’s where Hyderabad Home Loans comes in! We are a father-son duo, Vijay Arjun V and RamaRao.V, with a combined 28 years of experience as LIC Housing Finance advisors. We’re Top Associates – meaning we have a proven track record of success in helping Hyderabad residents secure their dream homes.

Details as of 18-07-2024 :

- LIC Home Loan interest rates and types (perfect for Hyderabad property seekers!)

- Factors affecting LIC Home Loan interest rates

- How Hyderabad Home Loans can help you get the best rates and a smooth approval process (with NO additional charges!)

LIC Home Loan Schemes & Interest Rates (July 2024):

LIC Housing Finance offers a variety of home loan schemes to suit different needs. Here’s a quick breakdown:

- Loan Amount: ₹1 lakh – ₹15 crore

- Loan Tenure: Upto 30 years (salaried) / Upto 25 years (self-employed)

- Interest Rates: 8.50% onwards (Rates vary based on factors like CIBIL score, loan amount, etc.)

Types of LIC Home Loans:

- LIC Griha Suvidha Home Loan: Ideal for those with extended loan terms or receiving part salary in cash.

- LIC Home Loan for Pensioners: Attractive rates for retirees (up to 65 years) with special benefits.

- LIC Home Renovation Loan: Finance home improvements or construction with competitive rates.

- LIC Home Loan Top-up: Get additional funds on your existing LIC Home Loan.

- LIC Home Extension Loan: Extend your existing loan tenure for more manageable EMIs.

- LIC Home Loan for NRIs: Purchase or construct a home in India even if you reside abroad.

- LIC Plot Loan: Finance the purchase of a residential plot.

- LIC Advantage Plus: Transfer your existing home loan to LIC and potentially enjoy lower rates and benefits.

Get Expert Help & Secure the Best Rates!

At Hyderabad Home Loans, we understand that navigating loan options and paperwork can be stressful. That’s why we offer:

- Free Consultation: Discuss your home loan needs and get personalized advice.

- Expert Guidance: We’ll help you choose the right LIC Home Loan scheme for your situation.

- Streamlined Application: We handle all the paperwork, ensuring a smooth process.

- Negotiation Expertise: We leverage our experience to help you secure the best possible interest rates.

- On-Time Approvals: Our strong association with LIC Housing Finance helps expedite approvals.

- Transparent Communication: We keep you informed throughout the entire process.

Why Choose Hyderabad Home Loans?

- Experienced & Reputable: 28 years of experience as LIC Housing Finance advisors.

- Top Associates: Proven track record of success in securing home loans for Hyderabad residents.

- No Extra Charges: Our services are completely free, with no hidden fees or commissions.

- Personalized Attention: We prioritize building relationships and understanding your unique needs.

- Stress-Free Process: We handle the legwork, allowing you to focus on finding your dream home.

Ready to take the first step towards your dream home?

Contact Hyderabad Home Loans today! Call us at 8886249998 or visit our website (link in bio) to schedule a free consultation.

Let Vijay Arjun V and RamaRao.V, your trusted LIC Housing Finance advisors, guide you towards homeownership success! Call now : 8886249998

Note:

- Interest rates are subject to change.